Lighthouse Wealth Management - An Overview

Wiki Article

Some Known Details About Lighthouse Wealth Management

Table of ContentsAll About Private Wealth Management CanadaNot known Facts About Investment RepresentativeFinancial Advisor Victoria Bc - QuestionsRumored Buzz on Tax Planning CanadaThe Facts About Lighthouse Wealth Management RevealedThe 5-Minute Rule for Investment Consultant

“If you're purchase something, say a tv or a personal computer, you'll wish to know the requirements of itwhat are the parts and exactly what it may do,” Purda details. “You can contemplate purchasing economic advice and support just as. Individuals need to know what they're purchasing.” With financial guidance, it's important to understand that the merchandise is not ties, stocks or any other assets.it is things such as budgeting, planning for pension or paying off personal debt. And like buying some type of computer from a dependable organization, customers want to know they're getting financial information from a trusted specialist. Certainly Purda and Ashworth’s best conclusions is about the charges that economic planners cost their clients.

This held correct no matter the charge structurehourly, fee, assets under administration or predetermined fee (inside the learn, the buck property value fees ended up being alike in each case). “It however boils down to the worthiness idea and anxiety on customers’ component which they don’t understand what they might be getting in change of these costs,” claims Purda.

Not known Details About Ia Wealth Management

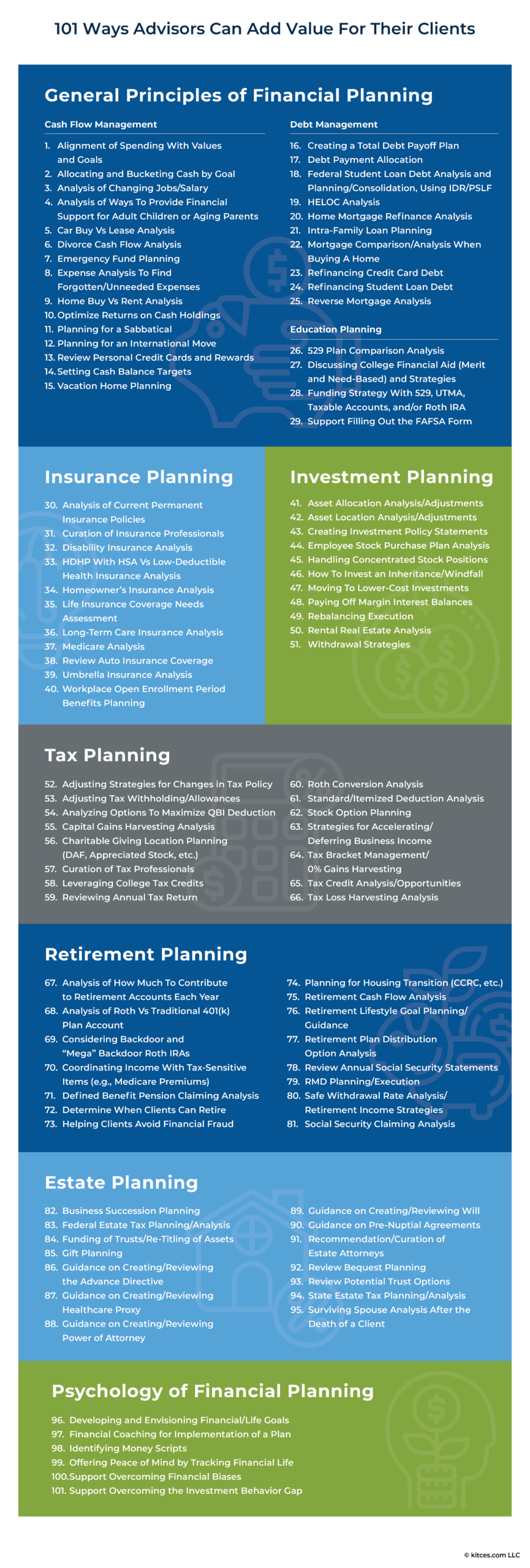

Hear this article as soon as you listen to the definition of monetary consultant, just what one thinks of? Many people remember a specialist who is going to give them economic information, particularly when considering spending. That’s a good starting point, although it doesn’t color the photo. Not near! Monetary analysts will people who have a number of some other money goals too.

A financial specialist assists you to create wealth and protect it for your long lasting. They're able to estimate your personal future economic needs and strategy strategies to stretch the pension cost savings. They may be able additionally give you advice on when you should start tapping into personal Security and making use of the income inside your retirement records so you can stay away from any awful charges.

Our Independent Investment Advisor Canada Diaries

Capable support ascertain exactly what mutual funds are right for you and explain to you simple tips to handle while making one particular of one's financial investments. They're able to also help you comprehend the risks and just what you’ll should do to realize your goals. A seasoned financial investment expert will also help you stay on the roller coaster of investingeven when your assets get a dive.

They can give you the guidance you ought to produce an idea to make fully sure your wishes are performed. And you can’t put an amount tag on satisfaction that include that. In accordance with a recent study, the typical 65-year-old pair in 2022 will need about $315,000 saved to cover health care expenses in pension.

The Main Principles Of Retirement Planning Canada

Since we’ve gone over exactly what economic experts perform, let’s dig in to the numerous kinds. Here’s have a peek at these guys a principle: All monetary coordinators are economic advisors, yet not all experts are planners - https://sketchfab.com/lighthousewm. A monetary planner centers around assisting people produce intentions to achieve long-term goalsthings like starting a college account or keeping for a down payment on a property

So how do you understand which monetary expert is right for you - https://www.startus.cc/company/647135? Here are a few things to do to ensure you’re choosing the best person. Where do you turn once you have two bad options to choose from? Easy! Find a lot more solutions. The greater options you may have, the much more likely you might be which will make an effective decision

Everything about Independent Investment Advisor Canada

All of our wise, Vestor plan causes it to be possible for you by revealing you up to five economic analysts who are able to serve you. The best part is, it is totally free attain associated with an advisor! And don’t forget about to come to the meeting ready with a list of concerns to inquire of so you can decide if they’re a great fit.But tune in, simply because an expert is actually wiser compared to the normal bear doesn’t give them the authority to inform you what to do. Sometimes, analysts are loaded with themselves because they do have more levels than a thermometer. If an advisor starts talking-down for your requirements, it's time to show them the entranceway.

Remember that! It’s important that you along with your financial advisor (whoever it ends up being) are on similar page. You would like a consultant who has got a lasting investing strategysomeone who’ll promote you to hold trading constantly if the market is up or down. ia wealth management. You don’t wish to work with a person who pushes one purchase something’s too dangerous or you’re not comfortable with

The Facts About Private Wealth Management Canada Uncovered

That mix will provide you with the diversification you'll want to successfully spend for long haul. While you study economic experts, you’ll probably find the word fiduciary task. This all indicates is any specialist you employ needs to act in a fashion that benefits their particular customer and not their own self-interest.Report this wiki page